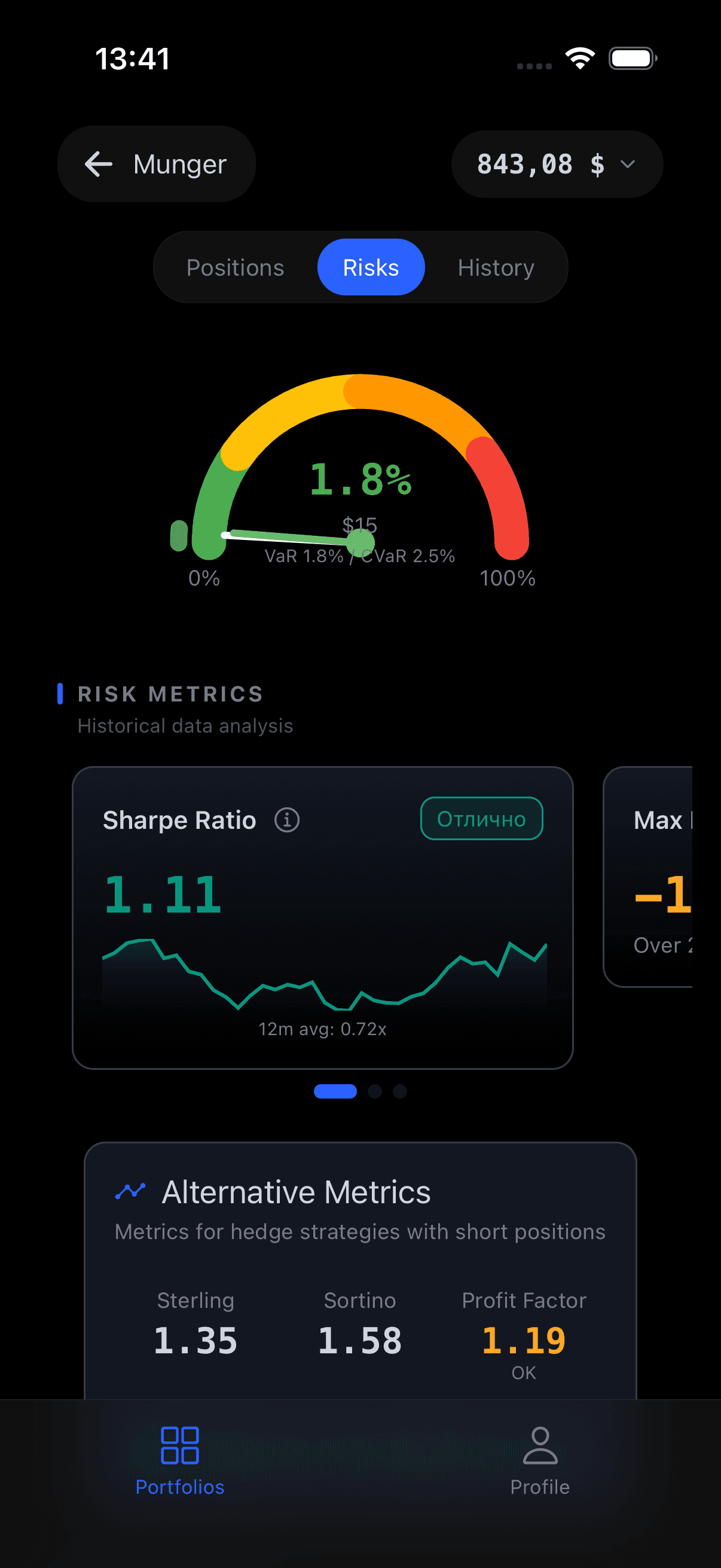

RiskOfficer empowers individual investors with professional-grade risk analytics previously reserved for institutional trading desks. While standard brokerage apps focus on past performance, RiskOfficer focuses on your future exposure and portfolio health. Key Features: Advanced Risk Metrics: Real-time calculation of Value at Risk (VaR), Expected Shortfall, Beta, and Volatility. Scenario Stress Testing: Simulate how your portfolio performs during historical market crashes (e.g., 2008 Crisis, Dot-com Bubble) or hypothetical scenarios. AI Integration: Use our new API keys to connect with AI assistants like OpenClaw, allowing you to query your risk data using natural language. Performance Analysis: Track Sharpe Ratio, Sortino Ratio, and Maximum Drawdown to understand your risk-adjusted returns. * Privacy First: Your data is secure; we provide analytics without taking custody of your assets.

Comments

Publisher

Riskofficer

StatusLive

Launch Date2026-02-14

Platformmobile

Pricingfree

Tags

#Fintech#Finance#Stock Market#AI#Crypto